The Organic Trade Association (OTA) strongly opposes the USDA’s recently proposed rule to rescind the Market Development for Mushrooms and Pet Food Rule. Unlike previous regulatory actions, this proposal was issued without consultation with the National Organic Standards Board (NOSB)—the federal advisory body established by Congress to ensure transparent and trade-informed development of organic standards. This departure from established protocol threatens to undermine stakeholder trust and the integrity of the organic regulatory process while also setting a troubling precedent.

Organic is a voluntary program built on a public-private partnership to deliver market differentiation, consumer trust, and economic opportunity. The USDA’s proposal runs counter to these goals by rescinding standards that bring clarity and opportunity to underserved segments of the organic market.

OTA urges all organic stakeholders to submit comments to the open docket opposing the proposed rescission by June 11 at midnight ET. Public engagement is critical to ensuring that organic remains a credible, inclusive, and forward-looking program that serves both producers and consumers. The USDA’s proposed rollback would undo over 15 years of stakeholder collaboration, NOSB recommendations, and industry development. It threatens to remove access to the USDA organic label for organic pet food and weaken the competitive position of U.S. mushroom producers.

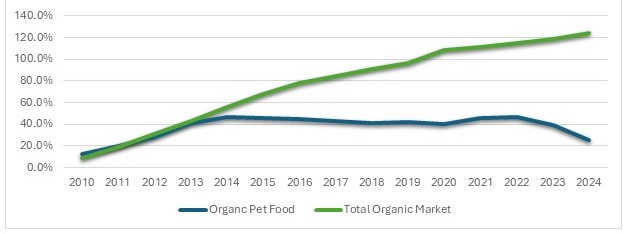

The final rule issued in 2024 provided long-overdue regulatory clarity for the organic pet food sector, which has shrunk from $125 million in sales in 2015 to just $104 million in sales in 20241. Pet food as a category has not experienced the same tremendous growth that organic food and agriculture has experienced. The lack of defined standards stifled growth and discouraged innovation. The rule aligned organic pet food formulations with AAFCO nutritional guidelines, authorized the use of organic animal by-products, and permitted essential amino acids necessary for complete and balanced pet food production.

Cumulative Annual Growth % of the Organic Market, 2010-2024

The pet food industry utilizes 6.4 million tons of animal by-products annually, valued at $8.5 billion2. Without a regulatory framework, organic producers—especially livestock farmers in states such as Pennsylvania, California, Wisconsin, North Carolina, Arkansas, and Texas—would lose access to this market and the organic premiums it provides.

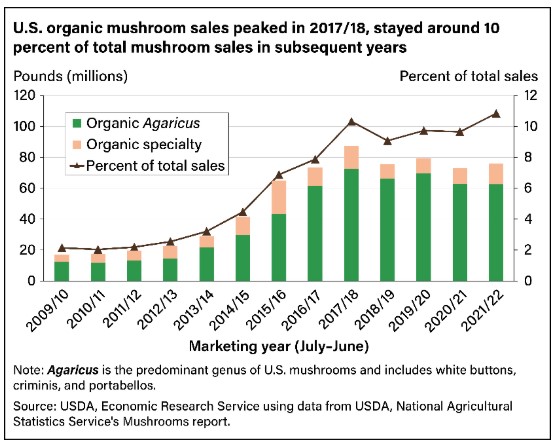

The mushroom industry faces similar threats. While countries like Canada have had organic mushroom standards in place for years, U.S. producers are falling behind. Growth of the organic mushroom marketplace has come from imports since 2017. USDA’s Economic Research Service reported $654 million in U.S. mushroom imports, with OTA estimating over $120 million in organic imports—most from Canada. Rescinding domestic standards risks further erosion of competitiveness for U.S. mushroom growers.

OTA urges USDA to reverse course, preserve the 2024 rule, and consult with the NOSB before taking further regulatory action. The association encourages all members of the organic community to submit public comments in support of maintaining clear, practical, and inclusive standards for organic mushrooms and pet food. Together, the organic sector can ensure the program remains a source of opportunity.

Please make your voice heard. You can submit your comments here before midnight ET on June 11, 2025:

Click here to submit your comments

Key Messages

1. USDA needs to consult the NOSB before changing organic standards.

In proposing to rescind the final market development rule, USDA bypasses the National Organic Standards Board (NOSB) and, by doing so, proposes a rule that trade did not ask for and that undermines the transparency and public accountability at the core of the organic program.

2. Rescinding pet food standards hurts organic farmers and blocks market access.

Without a regulatory framework, organic livestock producers—particularly in states like Pennsylvania, California, Wisconsin, North Carolina, Arkansas, and Texas—lose access to a growing, high-value market for animal by-products, reducing their ability to earn organic premiums.

3. Repealing the rule blocks the development of the organic pet food sector.

After years of stalled growth due to regulatory uncertainty, the 2024 rule finally opened the door to a viable organic pet food market. Rescinding it shuts that door again—preventing innovation, investment, and expansion in a category with clear consumer demand and supply chain potential.

1 OTA’s Organic Market Report 2025 - https://ota.com/resources/market-analysis

2 Pet Food Production and Ingredient Analysis, March 2025 - https://www.afia.org/pub/?id=acc22f76-f91e-ba27-3fdd-7cc941cb1c34