In a major policy shift, USDA Deputy Secretary Vaden announced this week that the agency will not allocate any Specialty Sugar Quota (SSQ) volume to support the organic marketplace for fiscal year 2026 (beginning October 2025), resulting in over $85 Million in new additional tariffs on organic sugar imports. USDA stated this decision was aligned with Secretary Rollins’ “Farmers First” agenda but is expected to significantly raise the cost of organic sugar and disrupt U.S. manufacturing supply chains.

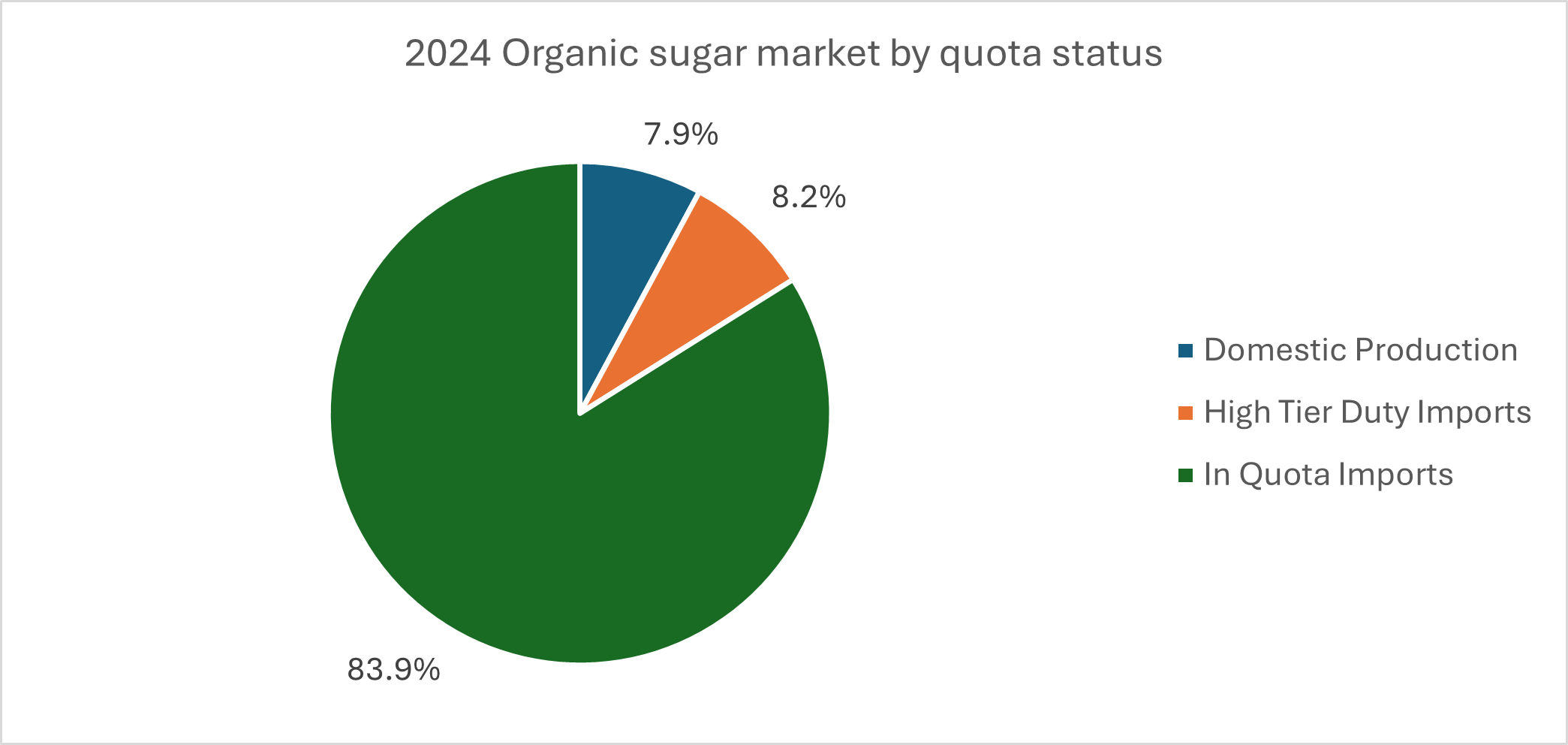

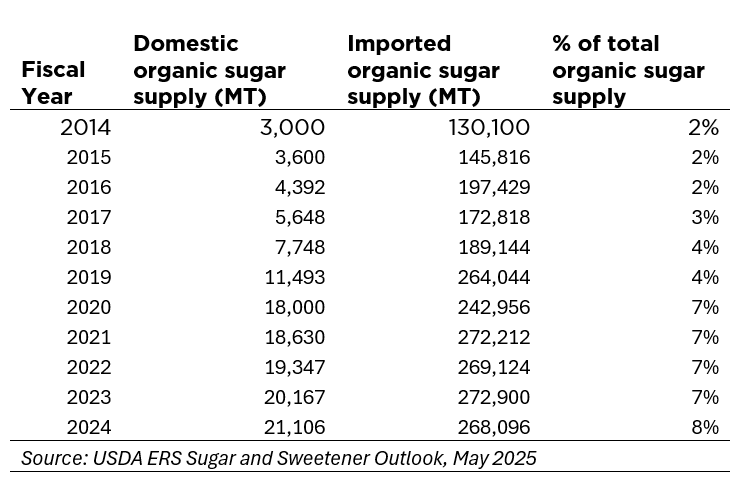

Historically, USDA has designated organic sugar as eligible for import under the SSQ due to the extremely limited availability of domestic production. According to the Economic Research Service (ERS), there is only one domestic producer of organic sugar, supplying less than 8% of U.S. demand. In FY2025, USDA permitted 210,000 metric tons (MT) of organic sugar to enter under the SSQ; even with that quota, an additional 36,000 MT entered, 22,000 MT of which incurred high-tier tariffs of $357.40 per MT.

According to the USDA, the decision was intended to protect domestic sugar production, stating: “Over the last 20 years, sugar imports have more than doubled and producers have lost 15% of the U.S. sugar market to imports, leading to closures of mills and processors.” However, this rationale appears to address the broader conventional sugar market—not the organic sugar segment, which accounts for approximately 99% of the blocked specialty sugar quota. In fact, USDA’s own data shows that while organic sugar imports have only doubled, domestic organic sugar production has grown sevenfold over the same period.

New Tariff Burden Hits Organic Supply Chain

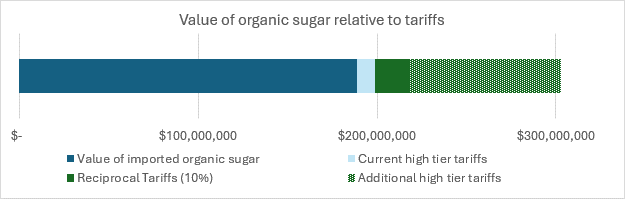

With the SSQ eliminated for FY2026, the organic sector will face an estimated $85 million in new tariff costs beginning October 1, 2025. OTA analysis shows that tariffs will make up approximately 34% of the landed cost of organic sugar. This is up from just 4% last year, and 12% this year after the introduction of reciprocal tariffs.

The implications on domestic producers of sugar-containing products is significant. The USDA organic rules do not allow for the use of non-organic sugar in any product that cares the USDA organic seal and the bulk of organic sugar is either purchased directly by consumers for use at home or used in combination with U.S.-grown ingredients, such as dairy, wheat, and fruit, to make a wide range of products, including yogurt, chocolate milk, ice cream, cookies, granola bars, kombucha, seltzers and so many others.

The loss of the SSQ places U.S. manufacturers at a competitive disadvantage, particularly against Canadian producers who do not face these tariffs and may qualify for preferential treatment under the U.S.-Mexico-Canada Agreement (USMCA).

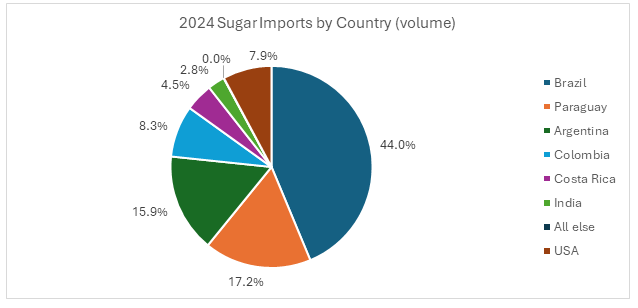

Further Tariff Risks on Brazilian Organic Sugar

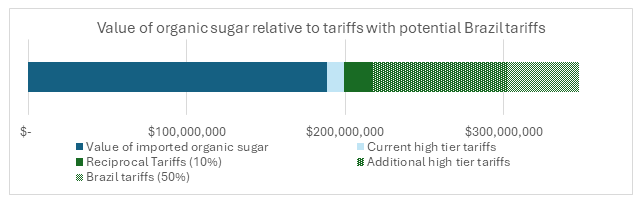

Imported organic sugar primarily comes from South America making up more than 90% of imports. Brazil currently supplies 44% of the U.S. organic sugar market. On July 9, President Trump proposed a new 50% tariff on all imports from Brazil, effective August 1. If imposed, this new tariff could cost the organic sector an additional $44 million annually, pushing total tariff costs for organic sugar over $158 million and bringing total landed tariff burdens to 46% of the price of organic imported sugar at port. To date, other major organic sugar exporting countries (Paraguay, Argentina and Colombia) have not received a recent trade letter from the trump administration, but each are currently subject to 10% reciprocal tariffs.

OTA Responds

The Organic Trade Association (OTA), through its Sugar Supply Task Force, continues to advocate for the Specialty Sugar Quota and a sufficient supply of organic ingredients. The Task Force is open to organic sugar producers, importers, and end users. OTA encourages all businesses affected by these developments, whether positively or negatively, to join the discussion and shape the path forward. To participate or learn more, please contact Sarah Gorman, OTA's International Trade Manager.