If you're filling up your shopping cart with organic products, it's easy to take for granted how global your food is. That quick breakfast of organic yogurt with granola and some fruit might include ingredients from multiple continents. Your yogurt might be made with organic milk from a U.S. dairy, but the oats, flax, and cranberries in your granola may have come from Canada. The banana? Probably from Mexico or Ecuador. And if you're enjoying organic blueberries in February, odds are they traveled from Chile. And let’s not forget your U.S. roasted organic coffee, which likely started as beans grown in Peru, Honduras, or Indonesia.

So how can we be confident that these imported organic products meet U.S. organic standards?

Two Pathways for Organic Imports

There are two methods for foreign imports to be sold as USDA-certified organic:

- Direct USDA Organic Certification Abroad:

Many foreign farms and businesses go through the same rigorous USDA certification process that U.S. producers do, just via accredited certifiers located overseas. These certifications are backed by mandatory NOP import certificates, adding greater transparency and traceability to the organic supply chain.

- Organic Equivalence Arrangements:

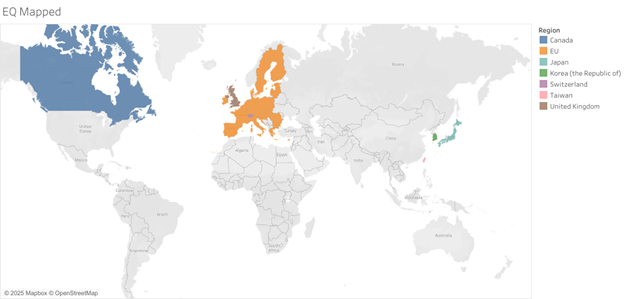

The U.S. currently has seven organic equivalence partners: Canada, the European Union, the United Kingdom, Switzerland, Japan, Korea, and Taiwan. These arrangements recognize that even though our organic standards may differ, they are fundamentally aligned in terms of integrity, verification, and outcomes.

In practical terms, equivalence allows a U.S. organic company to label and sell products as organic in those countries without having to jump through the hoops of a second certification system. There are some exceptions, known as critical variances, for key issues like animal health care or wine additives, but these are built into the arrangements. These arrangements are reciprocal, allowing companies in equivalent countries similar access to the U.S. market as well.

Equivalence depends not only on the similarity of written standards but also on a partner country’s capacity to maintain strong oversight and effective enforcement. Without rigorous monitoring, even well-aligned standards can break down in practice and create risks for fraud or consumer mistrust. That is why equivalence goes beyond comparing standards; it requires confidence that partner countries have the infrastructure and commitment to enforce them.

Lastly, these agreements are not static. They require ongoing audits, periodic renegotiation, and continuous monitoring. Without regular review, even trusted partners could drift apart in enforcement, creating the potential for vulnerabilities in the system.

Why Equivalence Is a Win for U.S. Organic Businesses

Equivalence arrangements are not simply trade formalities. They provide concrete, strategic advantages to U.S. organic businesses by reducing regulatory duplication, lowering certification costs, and removing barriers to entry in foreign markets. This is especially valuable for operations of all sizes. For operations with complex supply chains, it ensures that NOP certification is sufficient across their entire supply chain. This eliminates the cost, resources, and traceability burden of certifying back to the farm under a secondary standard. For small and mid-sized organic producers and manufacturers, it lowers the barrier to direct export by removing the need to navigate multiple national certification regimes and avoids redundant certification when selling to another U.S. operation intending to export.

Equivalency arrangements strengthen enforcement while saving taxpayer resources. By relying on vetted, trusted partners such as the European Union or Japan to oversee compliance within their own jurisdictions, the U.S. benefits from a global network of oversight and enforcement. This system promotes international information sharing, ensures regional focus, and allows for more efficient use of limited resources. Equivalency allows the U.S. to concentrate limited enforcement resources where they’re most needed, rather than duplicating work already carried out by trusted partners.

And while U.S. producers benefit from easier access abroad, U.S. consumers also gain year-round availability of products not widely grown domestically.

So… Who Benefits More?

While foreign producers often benefit from access to the world’s largest organic market, U.S. producers benefit from reduced barriers abroad. The two sides are not symmetrical; exporters into the U.S. seek consumer access, while U.S. exporters seek regulatory simplification, but both gain from stable, trusted equivalence arrangements.

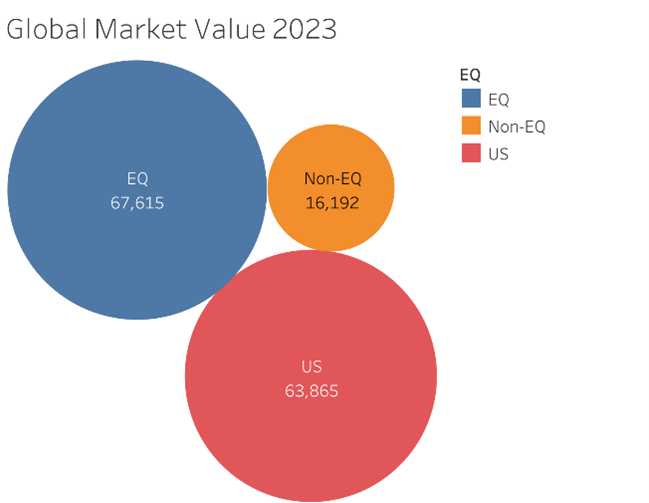

The global organic market reached $147 billion in 2023, with the U.S. commanding over 43% of that - more than the next 8 countries combined. That makes the U.S. the biggest organic consumer market in the world, and understandably, a very attractive destination for global organic producers.

The U.S. imports significantly more organic products than it exports, reflecting both the strength of domestic demand and the diversity of products we rely on from abroad. This reflects not only the strength of consumer demand, but also the range of products we need to source from abroad. For foreign producers, USDA organic certification offers access to a high-value market that would be (and already is) pursued regardless of equivalency.

Still, despite the trade differences, there are several benefits of equivalence for U.S. producers. Organic equivalency arrangements make it easier for U.S. businesses to access foreign markets with unique organic standards, which is especially valuable when those markets are small and would otherwise be too costly to enter due to regulatory hurdles. Combined, all of the markets that hold an equivalency with the U.S. total more organic retail sales than the U.S. market.

The Case for Continued Engagement

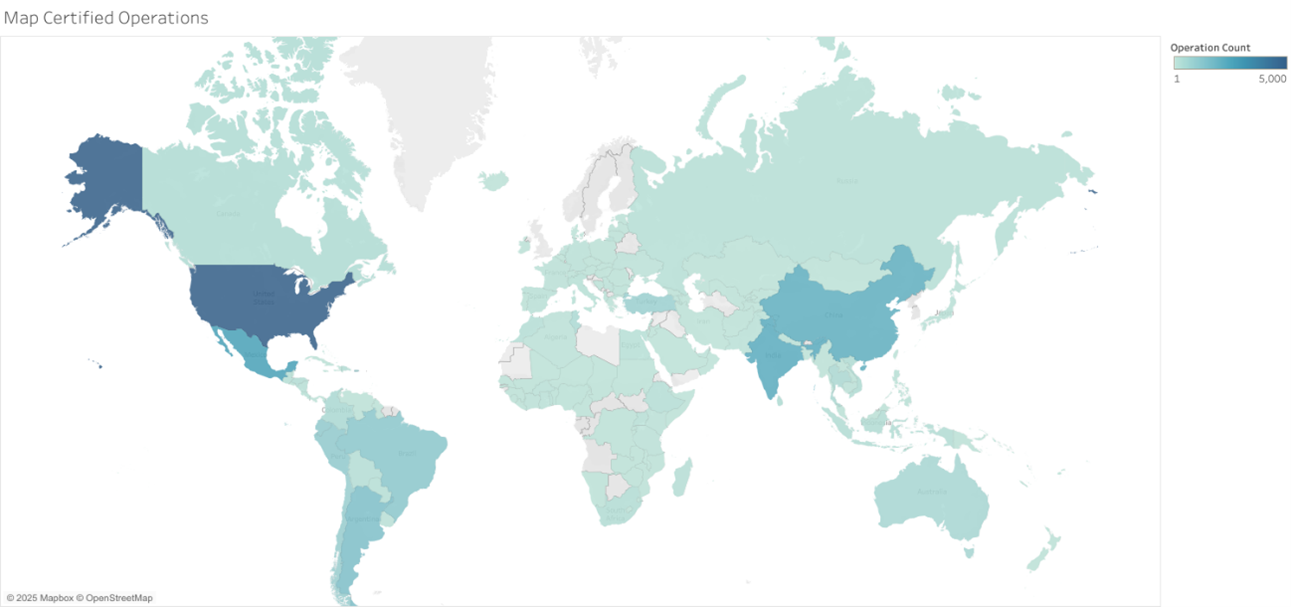

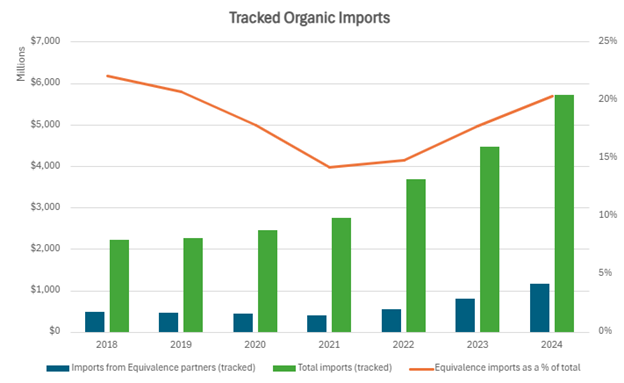

Data from the USDA Organic Integrity Database shows just how strong the U.S. organic market pull is:

- Over 48,000 operations are certified to the NOP standard.

- Just over 28,000 are U.S.-based, meaning around 20,000 are foreign operations that chose to get USDA certified because of the commercial opportunity NOP certification provides, both in the U.S. and in countries that accept NOP standards.

Compare that to what U.S. companies face abroad: without an equivalence arrangement, a U.S. organic business would have to get certified to each country’s individual organic rules—whether that’s Japan, Taiwan, the UK, or the EU. Foreign producers can secure U.S. access with a single USDA certification, but without equivalence, U.S. exporters must often pursue multiple foreign certifications, each extending through their supply chain. This asymmetry means equivalence is far more critical for U.S. exporters than for our trading partners. U.S. exporters already navigate a complex patchwork of regulations across markets, including differing rules on phytosanitary measures, food safety, maximum residue limits (MRLs), nutrition labeling, ingredients, and food additives, among other requirements. Adding separate organic standards on top of that, not only for the exporter, but for their entire supply chain back to the source, would make exporting organic products untenable. Equivalencies remove the burden that would be cost and time-prohibitive for most businesses and most markets, especially those with limited international experience or export infrastructure.

Mexico is an exception that proves the rule. Despite the absence of an equivalence arrangement, it is both the largest export destination for U.S. organic products ($296 million in 2024) and the largest exporter to the U.S. ($1.8 billion in 2024). Mexican producers pursue USDA certification regardless, drawn by the size of the U.S. market. But without equivalence, U.S. exporters face added certification burdens that likely constrain the full potential of bilateral trade.

Trade Data Tells a Clear Story

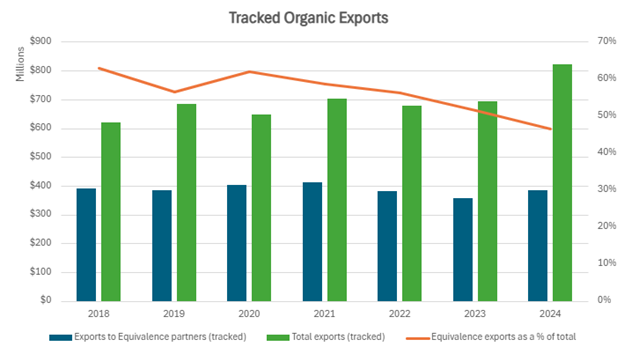

In 2024:

- 47% of tracked U.S. organic exports went to equivalence partner countries.

- Just 20% of tracked imports came from those same partners.

This demonstrates two key points: Foreign exporters are already investing in direct USDA certification to access our market, and U.S. exporters rely heavily on equivalence arrangements to remain competitive abroad.

Note: These charts only reflect organic products tracked through organic-specific HS codes. There are currently 41 organic export codes, and 157 organic import codes, meaning this data only captures a portion of total organic trade. Also note that the U.S. organic equivalence arrangement with Taiwan was signed in May 2020, so it is included as an equivalence partner beginning in 2021. Trade with the U.K. was captured under the E.U. equivalence until a separate arrangement was signed in 2021 following Brexit.

Looking Ahead: What Happens If We Stop Pursuing Equivalence?

If the U.S. government walked away from negotiating new equivalence deals, or fails to update existing ones, it would hurt U.S. exporters far more than our trading partners.

Here’s why: A foreign company can go through one USDA certification and gain access to a $71.6 billion market. That same opportunity doesn’t exist in reverse. U.S. exporters often won’t go through multiple foreign certification programs, making the absence of an equivalence a dealbreaker, not a speed bump.

As the U.S. explores potential new equivalence deals with countries like Chile and New Zealand, the playing field will likely tilt toward their exporters. But those businesses are already seeking USDA certification today. The bigger opportunity lies in opening those markets to U.S. producers who wouldn’t otherwise certify to foreign standards.

And because the U.S. organic market is so valuable, our government has significant leverage in negotiations to ensure strong, balanced deals that support American organic businesses and protect the integrity of the USDA organic seal.

Though organic equivalence arrangements may not grab trade headlines, they are one of the most powerful tools we have for growing U.S. organic exports while keeping our domestic industry competitive. As organic demand continues to rise globally, these partnerships will be key to ensuring that American organic businesses stay at the forefront, both at home and abroad.

📢 Stay Engaged on Organic Trade

Organic equivalence is essential for keeping U.S. farmers and businesses competitive in the global marketplace. OTA continues to advocate for strong, fair agreements that expand export opportunities while protecting the integrity of the organic label.

👉 Learn more about our international trade work, upcoming negotiations, and how you can get involved through OTA’s Organic International Trade resources: Explore OTA Trade Resources