Tariffs have become a cornerstone of the second Trump administration’s trade agenda, with April 2nd shaping up to be a key milestone. Referred to as “Liberation Day” by President Trump, this date could mark the implementation of four major, threatened tariff programs:

- Reciprocal tariffs on countries that levy tariffs on U.S. goods

- Tariffs on agricultural products

- Tariffs on foreign cars, semiconductors, and pharmaceuticals

- Tariffs on countries using Venezuelan oil and gas

What We Know—And Don’t Know

Details remain scarce, but recent signals suggest that the administration is focusing on what it calls the “Dirty 15”—countries that contribute to the largest U.S. trade deficits. While no official list exists, likely candidates based on trade data include China, the European Union, Mexico, Vietnam, and others.

This raises critical questions about how reciprocal tariffs will be structured:

- Country scope – Will tariffs be calculated per country, by regional groupings, or based on the size of the trade imbalance?

- Scope of barriers – Will only tariff barriers be targeted, or will non-tariff barriers—like subsidies, labor standards, and currency policies—also be factored in?

- Methodology – Will tariffs be calculated item-by-item, sector-by-sector, or using a trade-weighted average?

- Global response – Will other countries retaliate, or will they seek to negotiate lower barriers?

- Legal framework – How will these moves fit within WTO rules and existing trade agreements?

The “Dirty 15” vs. Organic Trade

There’s a notable overlap between the Dirty 15 and our largest trading partners for organic. The U.S. imports significant volumes of organic goods from Mexico ($2.3B), Canada ($1.8B), and the EU—all of whom are likely on the Dirty 15 list. India, Vietnam, and other major suppliers also appear on both the trade deficit and organic import/export lists.

"Dirty 15" - Top Trade Deficits | Top Organic Exports Countries | Top Organic Import Countries |

China | Canada | Mexico |

European Union | Mexico | Canada |

Mexico | Taiwan | European Union |

Vietnam | India | Peru |

Taiwan | Vietnam | Ecuador |

Japan | South Korea | New Zealand |

South Korea | Japan | Brazil |

Canada | Dominican Republic | Argentina |

India | Chile | Colombia |

Thailand | Nigeria | Chile |

Switzerland | Saudi Arabia | Honduras |

Malaysia | Australia | Turkey |

Indonesia | Cayman Islands | Tunisia |

Cambodia | Colombia | Togo |

South Africa | United Kingdom | India |

| Source: US Census, FAS GATS | ||

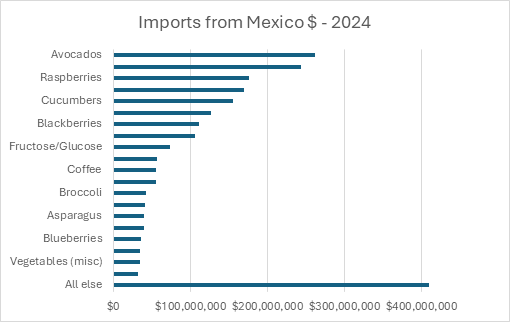

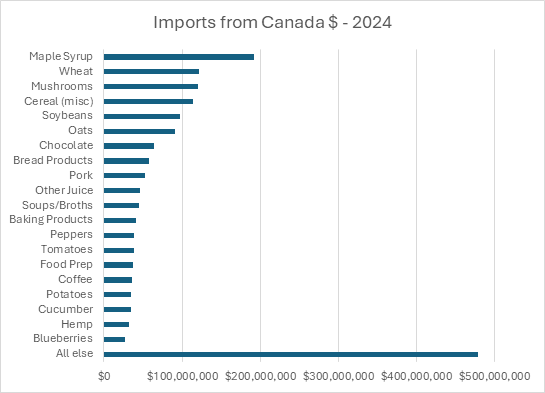

This overlap matters. Organic trade is deeply interconnected with many of the countries that may face new tariffs. For example, Mexico provides large volumes of organic avocados, strawberries, and raspberries. Canada supplies a diverse mix, from grains and processed products to meat and mushrooms. India is a major source of organic soy and ingredients used in processed foods.

The reciprocal tariffs could have mixed effects on the organic sector. On the risk side, higher tariffs on organic imports could increase prices for U.S. companies and consumers. Potential retaliatory tariffs could reduce demand for U.S. organic exports. These price hikes could slow organic’s post-COVID recovery, just as growth was stabilizing. On the opportunity side, sectors where the U.S. has a trade imbalance—such as organic soy, corn, and beef—may benefit from new protections. In addition, countries willing to negotiate, like Vietnam, could become more attractive trade partners.

What can I do?

With so many unknowns, companies are already taking precautionary steps. Some are stockpiling products ahead of the April 2nd deadline, where possible. Others are closely monitoring diplomatic developments in key export markets. Many are also engaging policymakers to ensure organic concerns are represented in any tariff decisions. OTA will continue to track developments closely and advocate for organic trade priorities as the situation unfolds. For now, vigilance and scenario planning are your best tools in preparing for what could be a major shake-up in global organic trade.